Occasionally I’ll hear from someone in their peak earnings years that although they are in a high tax bracket, they still want to contribute on a Roth basis to their 401(k) or IRA rather than getting a tax deduction up front. They assume that they’ll come out ahead if they get money into a Roth account where it can grow and compound never subject to taxation again. This is a misconception though if you expect to be in a lower tax bracket in retirement. Let me walk you through two examples to demonstrate this.

In this first example, if your income tax rate stays exactly the same over time, and if your investment return is the same in both account types, then the net after-tax result of investing in either a Traditional IRA or a Roth IRA is exactly the same. And this holds true for a Traditional 401(k) versus a Roth 401(k) as well. The first example below demonstrates this outcome:

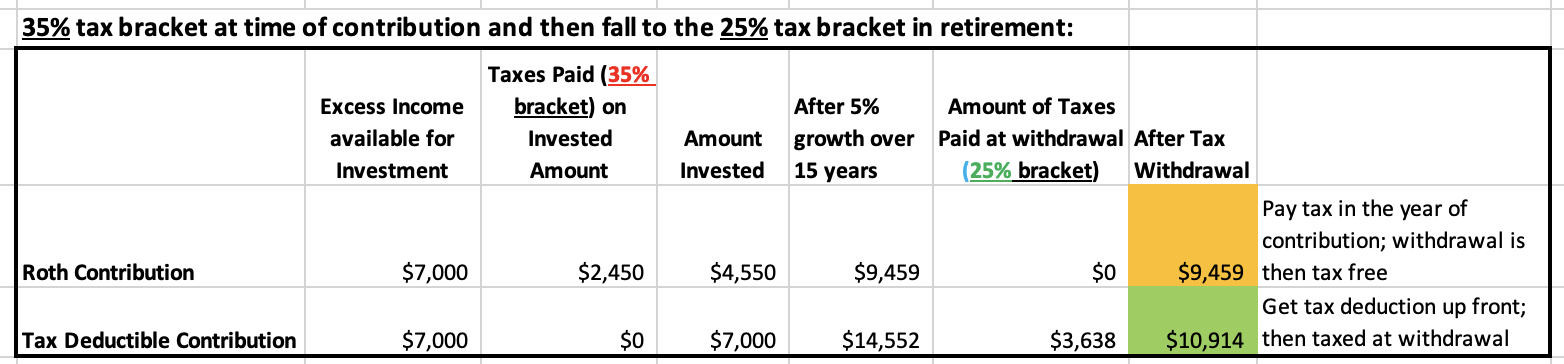

However, this next example shows that if you expect to be in a lower tax bracket in retirement then you come out ahead if you get the tax deduction during your peak earning years and then take it out when you are in a lower tax bracket in retirement.

So for those currently in higher tax brackets during their peak earning years, don’t be in a rush to pay the tax now. Consider biding your time until retirement.

Investing involves substantial risk and has the potential for partial or complete loss of funds invested. Investments mentioned may not be suitable for all investors. Before investing in any investment product, potential investors should consult their financial advisor, tax advisor, accountant, or attorney with regard to their specific situation.