If you find yourself in a low tax bracket in the early years of retirement, it might not be wise to let a low bracket go to waste.

For any years that you find yourself with minimal taxable income compared to what you expect later once Social Security and Required Minimum Distributions kick in, consider stuffing the lower tax brackets with partial Roth Conversions. That is, convert strategic amounts from Traditional IRAs to a Roth IRA in these early retirement years thereby paying taxes at a lower rate than you will likely pay later once your Social Security and Required Minimum Distributions start.

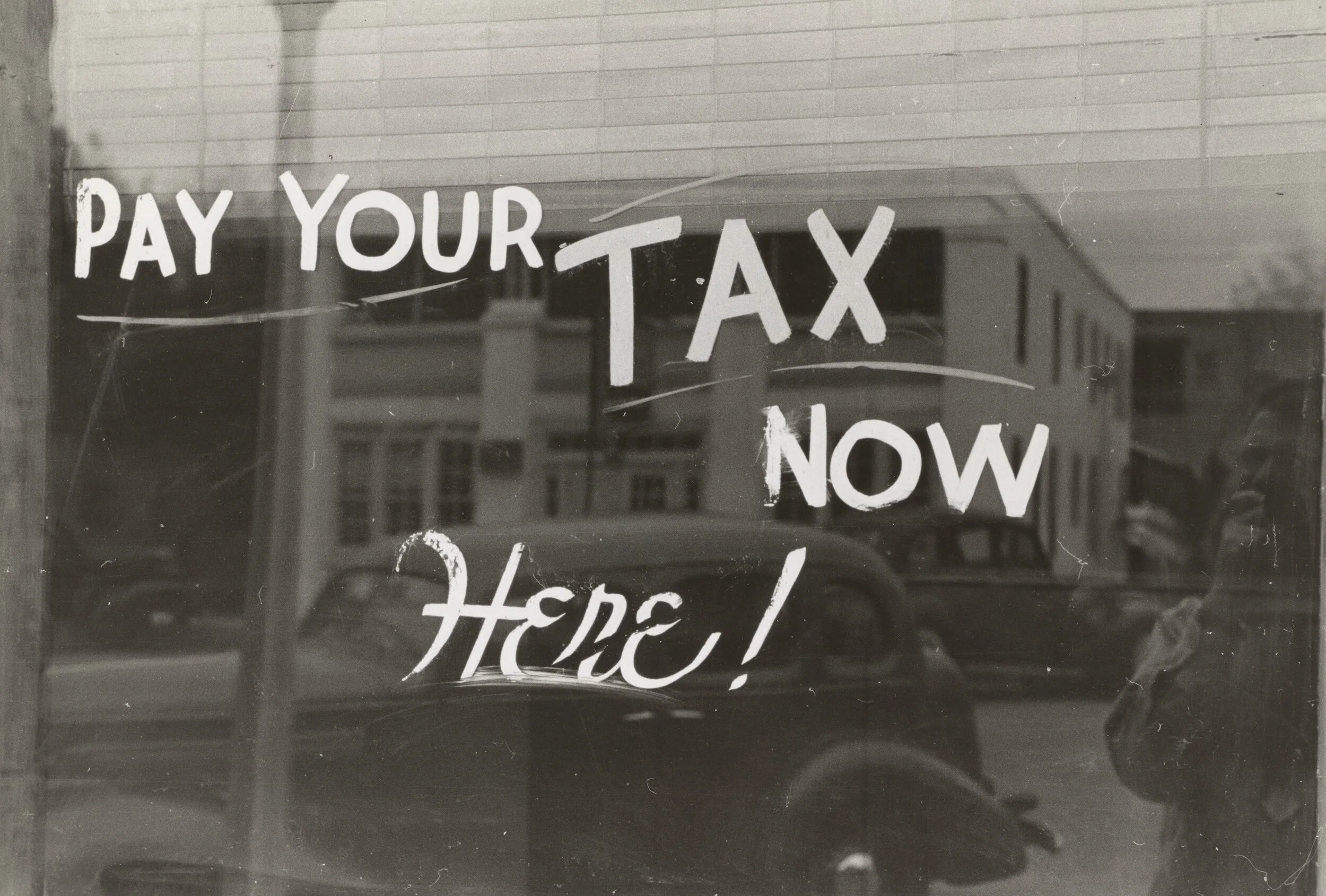

I know it can feel counter-intuitive to voluntarily pay taxes early, but it may make sense to accelerate taxes if you can pay them at a lower rate than you will have to pay later.

And strategic Roth Conversions in the early years can serve as a hedge against future tax rate increases. So if you think tax rates are likely to rise during your 25-30 year retirement span, then consider taking action now by doing some partial Roth Conversions.

And for married folks, Roth Conversions are also a hedge against the tax bracket shock of going from married filing jointly to being compressed into the single filer brackets if you or your spouse passes earlier than expected.

So if you think rates are going up in the future, then paying taxes now at a historically low rate is probably a good deal before the current tax rates sunset at the end of 2025.

There is a lot to consider before engaging in a Roth Conversion strategy including the impact on what you pay for Medicare, (i.e., the Medicare IRMAA surcharge), so I recommend working with a financial planner and a tax advisor before implementing any Roth Conversion strategy.

Investing involves substantial risk and has the potential for partial or complete loss of funds invested. Investments mentioned may not be suitable for all investors. Before investing in any investment product, potential investors should consult their financial advisor, tax advisor, accountant, or attorney with regard to their specific situation.